LLP registration in Bangalore

TALK TO EXPERTS

LLP stands for Limited Liability Partnership. It is a popular form of business entity in India that combines the benefits of a partnership and a limited liability company. In an LLP, the partners have limited liability for the debts and obligations of the business, and the LLP is a separate legal entity, distinct from its partners.

LLPs were introduced in India in 2008, under the Limited Liability Partnership Act, 2008. LLPs are governed by the Ministry of Corporate Affairs and are registered with the Registrar of Companies (RoC).

Requirement

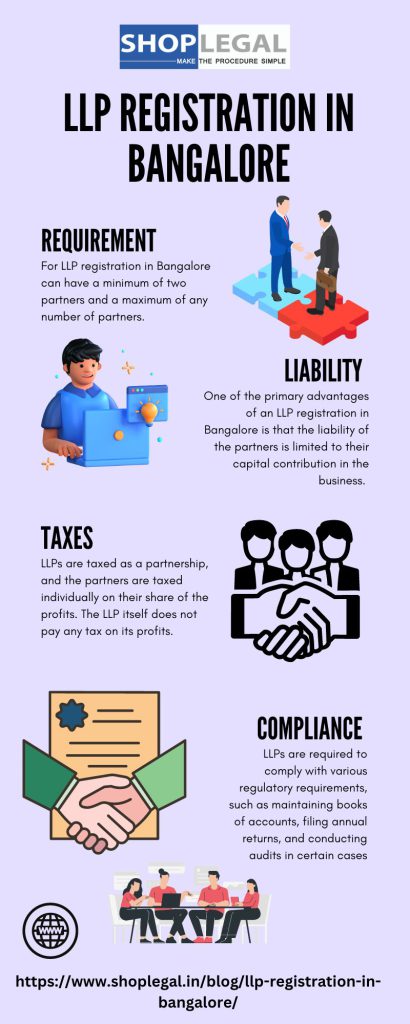

LLP registration in Bangalore can have a minimum of two partners and a maximum of any number of partners. Unlike a traditional partnership, there is no requirement for a designated managing partner in an LLP. All partners have the right to participate in the management of the business.

Advantages

One of the primary advantages of an LLP registration in Bangalore is that the liability of the partners is limited to their capital contribution to the business. This means that in the event of a financial loss or legal liability, the personal assets of the partners are not at risk. This is different from a traditional partnership, where the partners have unlimited liability.

Another advantage of an LLP is that it is a separate legal entity, distinct from its partners. This means that the LLP can enter into contracts, own property, and sue or be sued in its name. This provides a level of protection for the partners’ assets.

LLPs with LLP registration in Bangalore are also relatively easy to set up and operate compared to other business entities, such as a company. There is no requirement for a minimum capital contribution, and the compliance requirements are relatively straightforward.

However, there are some limitations to LLPs. For example, an LLP cannot raise funds from the public through the issue of shares or other securities. Also, LLPs are not suitable for businesses that require significant external funding, such as large-scale manufacturing or infrastructure projects.

How does limited liability partnership works?

Formation and Registration

To form an LLP and to get LLP registration in Bangalore, two or more individuals or corporate entities must come together and sign an LLP agreement, which sets out the terms of their partnership.

The agreement must be filed with the Registrar of Companies (RoC) along with the necessary documents, such as proof of identity and address of the partners.

Once the LLP registration in Bangalore process is complete, the LLP is issued a Certificate of Incorporation.

Management and Operation

In an LLP, all partners have the right to participate in the management of the business. However, the LLP agreement may designate certain partners as responsible for the day-to-day operations of the business. The agreement may also specify the profit-sharing ratio, the terms of admission or retirement of partners, and the dissolution of the LLP.

Liability

One of the primary advantages of an LLP registration in Bangalore is that the liability of the partners is limited to their capital contribution to the business.

This means that in the event of a financial loss or legal liability, the personal assets of the partners are not at risk. However, if a partner engages in any fraudulent activity or is found guilty of any other misconduct, they may be held personally liable.

Taxes

LLPs are taxed as a partnership, and the partners are taxed individually on their share of the profits. The LLP itself does not pay any tax on its profits.

However, an LLP with LLP registration in Bangalore is required to file an income tax return and comply with other tax obligations, such as withholding tax on payments made to non-residents.

Compliance

LLPs are required to comply with various regulatory requirements, such as maintaining books of accounts, filing annual returns, and conducting audits in certain cases. The LLP agreement may also specify additional compliance requirements.

Does limited liability partnership get 1099?

In India, there is no form called 1099. The concept of a 1099 form is specific to the United States tax system.

However, similar to the U.S., LLPs in India are required to file various tax returns and other forms as per the applicable laws and regulations.

LLPs in India are required to file an annual return with the Ministry of Corporate Affairs (MCA) in Form 11. This form includes information about the partners, their capital contribution, profit sharing ratio, and other details about the LLP which can get LLP registration in Bangalore.

LLPs are also required to file an income tax return in Form ITR 5 with the Income Tax Department. The tax return must include information about the LLP’s income, expenses, and other financial details.

In addition, LLPs in India may be required to file other forms and returns as per the applicable laws.

For example, if the LLP is engaged in certain types of transactions, such as foreign remittances, it may be required to file a Form 15CA/15CB or Form 10F with the tax authorities.

When LLP is liable for audit?

In India, the LLPs with LLP registration in Bangalore are required to undergo a mandatory audit under certain circumstances. The audit requirement for an LLP in India is governed by the Limited Liability Partnership Act, 2008, and the Rules made thereunder, as well as the Income Tax Act, 1961.

Here are the circumstances under which an LLP is liable for an audit in India:

Turnover:

If the LLP has LLP registration in Bangalore with a turnover exceeding Rs. 40 lakhs in a financial year, it is required to undergo an audit by a Chartered Accountant.

Capital contribution:

If the LLP’s capital contribution exceeds Rs. 25 lakhs, it is required to undergo an audit by a Chartered Accountant.

Foreign contribution:

If the LLP having LLP registration in Bangalore receives any foreign contribution, it is required to undergo an audit by a Chartered Accountant.

Partnership deed:

If the LLP’s partnership deed requires an audit, it must undergo an audit by a Chartered Accountant.

Statutory audit:

If the LLP with LLP registration in Bangalore is involved in certain types of business or transactions, such as banking, insurance, or non-banking financial activities, it may be required to undergo a statutory audit as per the applicable laws.

Conclusion

LLPs can be a good option for small and medium-sized businesses, particularly those that require flexibility in management and want to limit the personal liability of their partners. It is important for businesses to carefully consider their options and seek professional advice before choosing a business structure.