Trademark gst rate

TALK TO EXPERTS

In recent years, the introduction of the Goods and Services Tax (GST) in India has significantly impacted various aspects of business operations, including trademark registration. Understanding the implications of GST on trademark registration in Hyderabad is crucial for businesses to navigate the legal landscape effectively. In this comprehensive guide, we’ll delve into recent updates on trademark GST rates and explore its implications for businesses.

Understanding Trademark Registration:

Trademark registration provides legal protection to unique names, symbols, logos, or slogans that distinguish goods or services of one business from another. In India, trademarks are registered under the Trademarks Act, 1999, administered by the Controller General of Patents, Designs, and Trademarks (CGPDTM). Once registered, a trademark holder has exclusive rights to use the mark for their goods or services.

Importance of Trademark Registration:

Trademark registration offers numerous benefits to businesses, including:

Legal Protection: Registration provides legal ownership and protection against unauthorized use or infringement.

Brand Recognition: A registered trademark helps build brand identity and distinguishes products or services in the market.

Market Value: A strong trademark can enhance the market value of a business and attract investors or buyers.

Exclusive Rights: Trademark with trademark registration in Hyderabad grants exclusive rights to use the mark in the specified class of goods or services.

Enforcement: Registered trademarks enable businesses to enforce their rights against infringement or counterfeiting.

Understanding GST:

GST is an indirect tax levied on the supply of goods and services in India, aimed at replacing multiple indirect taxes with a single tax structure. The GST regime has streamlined tax administration, enhanced compliance, and reduced tax cascading.

Recent Updates on GST Rates:

As of recent updates, trademark services fall under the category of services provided by a legal consultancy firm. The GST rate applicable to legal consultancy services is determined by the nature of services provided.

GST Rate for Trademark Registration Services:

Trademark Application Filing: The GST rate for filing a trademark application is 18%. This includes the professional fee charged by trademark attorneys or agents for filing the application with the CGPDTM.

Trademark Search and Opinion: GST at the rate of 18% is applicable on trademark search and opinion services provided by legal consultants. This involves conducting a thorough search to determine the availability and registrability of a proposed trademark.

Trademark Registration: The GST rate for trademark registration services, including application filing and prosecution, is 18%. This covers all legal fees and administrative expenses incurred during the registration process.

Trademark Renewal: Renewal of trademark registration attracts GST at the rate of 18%. Businesses need to renew their trademark registration in Hyderabad every ten years to maintain their exclusive rights.

Implications of GST on Trademark Registration:

Cost Implications: The imposition of GST on trademark services increases the overall cost of trademark registration and maintenance for businesses. It’s essential for businesses to factor in these costs while budgeting for trademark-related expenses.

Compliance Requirements: Businesses must ensure compliance with GST regulations when availing trademark services. This includes proper invoicing, payment of GST, and filing of GST returns within the specified timelines.

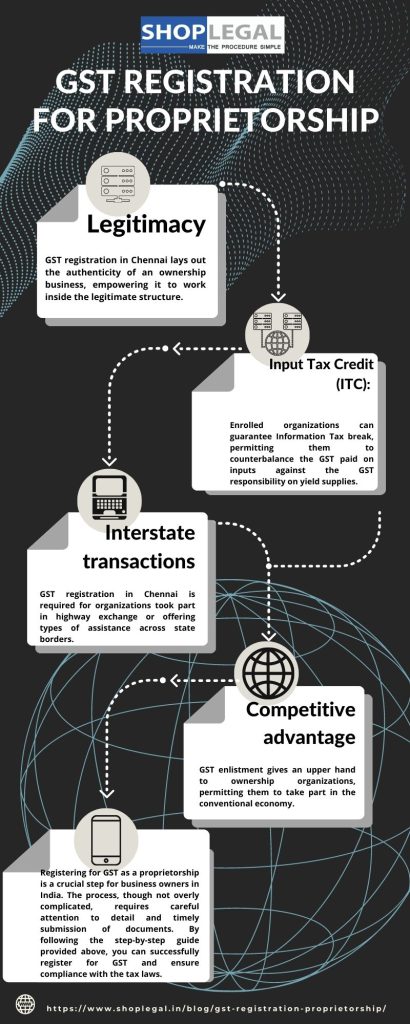

Input Tax Credit (ITC): Businesses registered under GST can claim input tax credit on GST paid for trademark services. This helps in reducing the overall tax liability and mitigating the impact of GST which can get GST registration in Bangalore on trademark-related expenses.

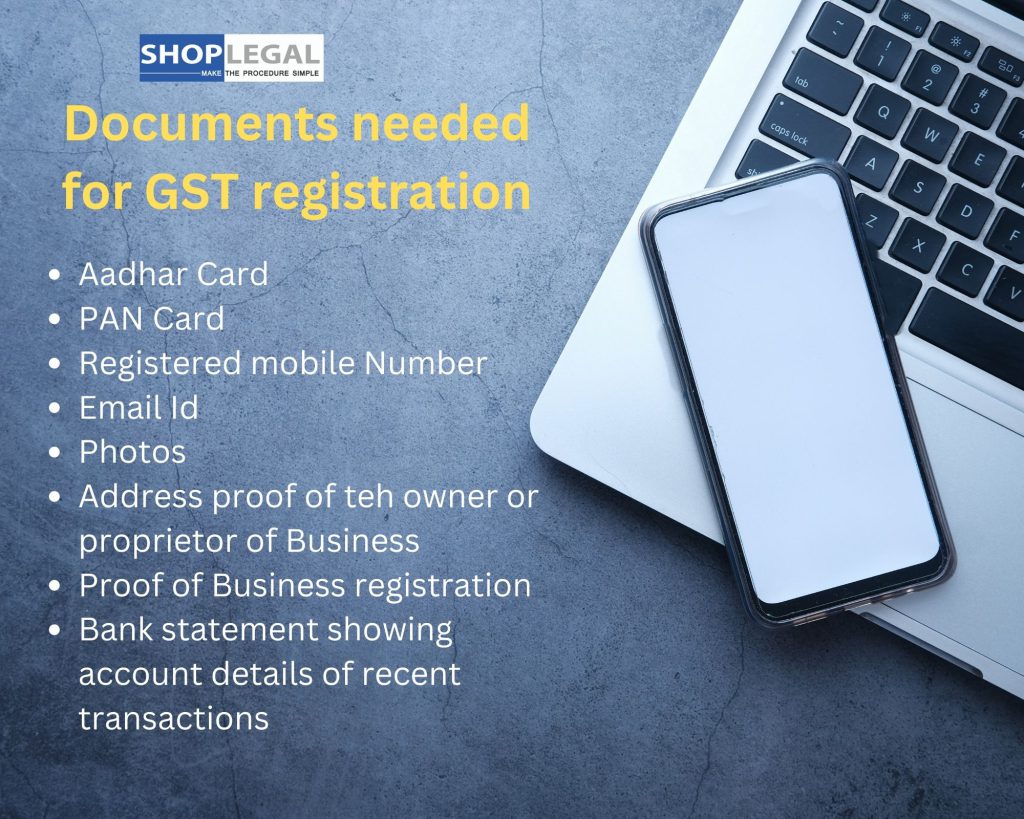

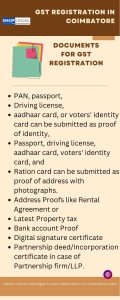

Documentation and Record-keeping: Proper documentation of invoices, receipts, and other related records is essential for claiming input tax credit and demonstrating compliance during GST audits.

Impact on Small Businesses: Small and medium-sized enterprises (SMEs) may face challenges in absorbing the increased costs associated with trademark registration due to GST. It’s important for SMEs to explore cost-effective options and consider the long-term benefits of trademark protection.

Consultation with Tax Experts: Given the complexities of GST regulations, businesses are advised to seek guidance from tax experts or consultants specializing in GST compliance. This ensures proper understanding of GST implications and helps in optimizing tax strategies.

Is GST applicable on sale of intellectual property?

The Goods and Services Tax (GST) affects different Intellectual Property (IP) deals, like licensing, selling, and transferring IP assets.

How GST applies depends on the type of deal and the tax rules of the area?

Licensing IP: When someone lets another person use their IP, it’s a service, and GST applies to the payment received for the license. For example, if a software maker allows a company to use their software, GST which can get GST registration in Karur is added to the money the company pays.

Selling IP: When a company sells IP assets like patents or trademarks, it’s treated as selling goods and GST applies to the selling price. For instance, if a company sells a patent to another, GST is added to the price.

Transferring IP: If someone transfers their IP to another, GST applies based on the payment in the transfer agreement. For example, if a creator gives their copyright to a publisher, GST is added to the payment they get for it.

Reverse charge mechanism in IPR-related GST laws

Reverse Charge Mechanism (RCM) in GST which can get GST registration in Chennai is a concept where the recipient of goods or services is liable to pay the tax instead of the supplier.

This mechanism is applicable in certain cases where the supplier is either unregistered or a composition scheme taxpayer. In the context of Intellectual Property Rights (IPR)-related transactions, the Reverse Charge Mechanism has specific implications.

Applicability of Reverse Charge Mechanism (RCM) in IPR Transactions:

In IPR-related transactions, RCM applies when services are procured from an individual advocate, a firm of advocates, or any other legal service provider. This includes services such as legal consultancy, representation before any court, tribunal, or authority, and legal documentation related to IPR.

What is the GST Exemptions and Provisions for International IPR Transactions?

GST exemptions and provisions for international Intellectual Property Rights (IPR) transactions aim to facilitate cross-border trade and promote innovation.

Under GST that can get GST registration in Karur, services provided to a person located outside India, or to a non-taxable territory, are considered exports and are zero-rated.

This means that GST is not levied on such transactions. Similarly, import of services for personal use or for business use where the supplier is located outside India is also exempt from GST.

These provisions encourage international collaborations and protect the competitiveness of Indian businesses in the global market.

Conclusion:

The recent updates on GST rates for trademark services highlight the importance of understanding the implications of GST on trademark registration in Hyderabad. While GST adds to the cost of trademark registration, businesses can leverage input tax credit and adopt efficient tax planning strategies to mitigate its impact. By staying informed and compliant with GST regulations, businesses can protect their trademarks effectively and enhance their brand value in the competitive market landscape.