TALK TO EXPERTS

The Goods and Services Tax (GST) Act requires all suppliers and manufacturers of goods and services to register for the tax. All of the indirect tax categories—such as service tax, entry tax, sales tax, excise duty, and customs duty—have been combined into a single tax system under this new form of the tax regime, which went into effect on July 1, 2017.

As a result, it eliminates the tax structure’s complexity when conducting business. GST rates range from 0% to 28%, depending on the kind of goods or services your company sells. Anyone who violates the law should face severe penalties that can amount to up to one hundred per cent of the amount you owe in taxes.

The entire GST registration process is completed online, and the applicant receives a unique identification number, or GSTIN, which entitles them to numerous benefits offered by the state and federal governments. In addition, the certificate provides legal recognition for both your company and yourself.

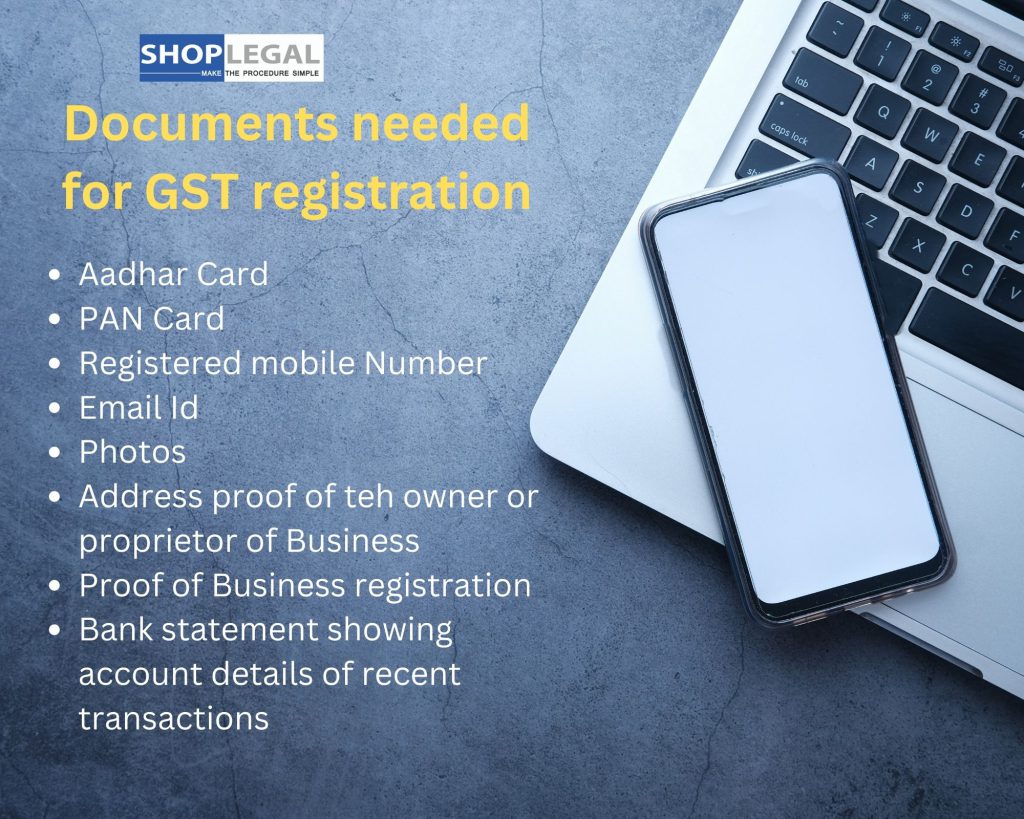

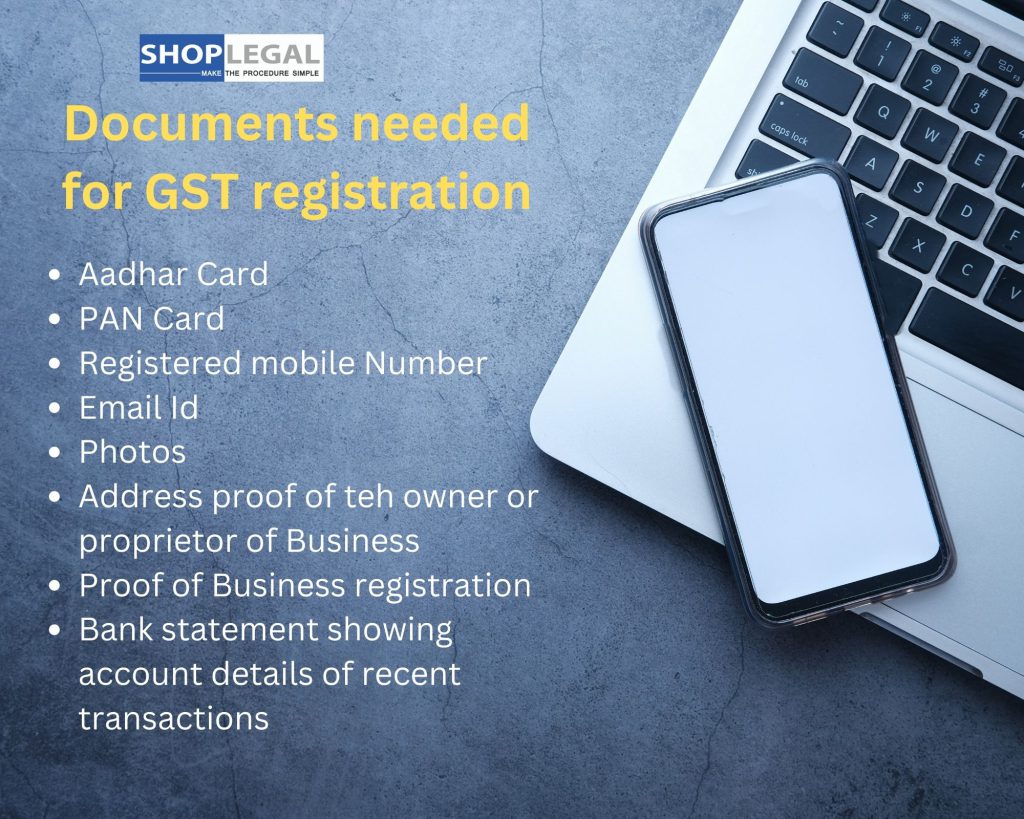

GST registration and other services can be completed with the assistance of knowledgeable professionals. You must submit the necessary paperwork to complete the process to enlist successfully.

Process of GST registration

You can fill out your GST registration in Karur form right here if you visit our website at https://www.shoplegal.in/gst-registration-in-karur.php

The time required to obtain a GSTIN varies from person to person based on the concerned officer after the required documents have been submitted and the GST registration has been completed successfully.

The candidate, either an individual or a business substance, will get the legitimate endorsement of GST registration in Karur within 5-12 working days through the Public authority entrance for GST enrollment.

You will, however, be able to receive it within one to three days if the entire procedure for GST registration in Karur is completed with the assistance of the GST registration consultant.

Benefits of GST registration

The fact that a product will be available at the same price across the country is one of the main benefits of GST. However, this benefit applies to goods covered by the GST tax slab.

The introduction of GST which has GST registration in Karur into the economy has made it easier than ever to track taxes.

Customers can be fully aware of the amount they are paying in taxes for the goods and services because GST that has GST registration in Karur operates on a computerized system.

Wholesalers, retailers, importers and exporters, and so on are all examples of traders. The degree of openness afforded by GST is one of its most significant benefits.

Since traders must pay GST that has GST registration in Karur for everything they purchase along the supply chain, it simplifies business transactions.

Under the GST tax system, this is an additional significant advantage for any business.

A better flow of action between the various traders can be maintained with the clarity of market procedures.

How to register casual taxable person in GST?

Under GST, casual taxable individuals have received special treatment. A person who occasionally engages in transactions involving the supply of goods or services, or both, in the course or furtherance of business, whether as a principal, agent, or in any other capacity, in a State or Union territory.

Where the entity has no fixed place of business is considered a casual taxable person under the GST Act. As a result, individuals operating seasonal businesses or temporary businesses at fairs or exhibitions would be considered casual taxable persons under GST that has GST registration in Karur.

Regular taxable person vs Casual taxable person

The GST registration in Karur as a regular taxable person is required for individuals who fall into this category. These people will be subject to the regular person’s tax, not the casual taxable person or non-resident taxable person categories.

As a result, a person who has a fixed place of business in India would be considered a regular taxable person.

A regular taxpayer would be required to file monthly GST returns, maintain accounts following the GST Act, maintain a fixed place of business, and comply with GST regulations unless they are enrolled in the GST composition scheme.

Because their business is seasonal and does not have a fixed location, casual taxable individuals would have difficulty maintaining a fixed location or consistently filing monthly GST returns.

The GST Act in which GST registration in Karur is done makes special provisions for the registration of casual taxable persons to meet the particular requirements of these taxpayers.

Registration of GST for casual taxable person

Regardless of their annual total revenue, casual taxable individuals should all be required to have GST registration in Karur.

Further, the easygoing available individual will apply for GST registration in Karur somewhere around 5 days before the initiation of business.

The FORM GST REG-01 can be used by casual taxable individuals to have GST registration in Karur.

Validity of GST registration

The GST registration in Karur is valid for the period specified in the application, or for 90 days from the registration date, whichever comes first.

The following example of a certificate of GST registration in Karur shows that the GST only specifies a validity period for casual taxable individuals and non-resident taxable individuals.

Types of GST

Taxes are levied by both the central and state governments in India. Every supply of goods and services is subject to taxes. For GST the constitution has given a reasonable division of abilities and obligations while gathering income from tax collection.

CGST

The central GST that has GST registration in Karur, also known as the Combined Goods and Services Tax, is a tax that applies to goods and services provided in a state and is administered by the central government.

SGST

SGST which can have GST registration in Karur is a tax that is imposed by the state government on all intrastate supplies of both goods and services and is governed by the SGST Act.

IGST

At the point when the area of the provider and the area of supply is in two distinct states then, at that point, all things considered, IGST that can get GST registration in Karur is gathered by the central government.

Recent news

Realtors want the government to rationalize the GST on properties that are still under construction in an effort to increase sales.

Real estate professionals and developers want the government to rationalize the Goods and Services Tax (GST) that can get GST registration in Karur on properties in the process of construction to encourage sales of those properties. As buyers are required to pay the GST in addition to stamp duty and registration fees, the sale of properties that are still in the construction phase has decreased.

According to real estate expert Pankaj Kapoor, founder and managing director of Liases Foras, the decline in sales of properties that are still under construction is troubling. GST is levied on under-construction properties;

Consequently, ready-to-move-in properties are preferred by many homebuyers. Additionally, there are fewer risk factors associated with ready-to-move-in properties. As a result, developers rush to finish the property to attract sales, which requires them to borrow money.

In addition to the interest on borrowings, the property value is increased by the increased input cost, which the customer must indirectly pay for. The government ought to rationalize the GST with GST registration in Karur as a result.

In a similar vein, well-known developer Dhaval Ajmera, director of Ajmera Realty And Infra India Limited, stated to The Indian Express that “Imposing GST is making the project and sale of flats further expensive.”

Previously, there was a rebate that cut costs, but now there isn’t one, so the price is high. It is passed on to the customer indirectly.

In the meantime, as of April 1, the government will tax capital gains up to Rs 10 crore. In the luxury market, including land and commercial office space, Kapoor anticipates an increase in cash transactions.

He emphasized that the introduction of capital gains taxes may increase the amount of black money in the real estate market.

Features of GST

PAN is required for GST registration in Karur.

Once a supplier is required to register, he must register under the same PAN in each state or territory in which he operates.

A centralized registration is unheard of. The supplier must obtain state-specific GST registration in Karur.

A provider needs to get GST registration in Karur in each State/UT from where he makes available stock.

Given his total turnover surpasses a predetermined edge limit. As a result, he does not need to register with a State or UT from which he makes a supply that is not subject to tax.

About Us

Shoplegal is the best legal service provider. We are serving across India.